Great! You’ve decided to set roots in Utah, the land of stunning landscapes and vibrant communities. But before you picture yourself sipping tea on a cozy porch overlooking the Wasatch Range, there’s the hurdle of navigating the home-buying journey. This guide will provide a one-stop shop for buying a home in Utah real estate market.

In this article:

- Why Buy a Home in Utah?

- Understanding the Utah Real Estate Market

- Utah Home Buying Statistics

- Median Home Sale Prices in Utah

- Important Financial Information

- Tips for First-Time Homebuyers in Utah

- Utah Down Payment Assistance and Loan Programs

- Next Steps to Buying Your Utah Home!

- Resources for Utah Homebuyers

Why Buy a Home in Utah?

Utah is known for its stunning landscapes, strong economy, and family-friendly communities. Here’s why buying a home in Utah could be one of the best decisions you make:

- Booming Economy: Utah boasts a robust job market, particularly in tech and healthcare, which makes it a prime location for career growth and stability.

- Outdoor Lifestyle: From skiing in Park City to hiking in Zion National Park, outdoor enthusiasts will find plenty to love. Utah’s natural beauty offers numerous recreational opportunities year-round.

- Family-Friendly: With excellent schools and safe neighborhoods, Utah is a great place to raise a family. Communities are designed to be welcoming and supportive, making it an ideal place for young families.

Understanding the Utah Real Estate Market

The Utah real estate market is unique and has its own set of trends and characteristics:

- Growth Areas: Salt Lake City, Provo, and St. George are some of the fastest-growing areas, attracting new residents due to their vibrant economies and desirable living conditions.

- Price Trends: While prices have been rising, there are still affordable options, particularly in emerging neighborhoods across the valley. This offers opportunities for both first-time homebuyers and those looking to invest in real estate.

Utah Home Buying Statistics

Understanding the current market statistics can help you make informed decisions:

| Statistics about Utah Home Buying | |

| Average sale price of homes in Utah (June 2024) [i] | $545,900 |

| Home price increase from June 2023 [ii] | 2.6% |

| Minimum down payment in Utah (3%)* | $16,377 |

| 20% down payment in Utah* | $109,180 |

| Average credit score in Utah [iii] | 731 |

| Average age for first-time Utah homebuyer | 36 |

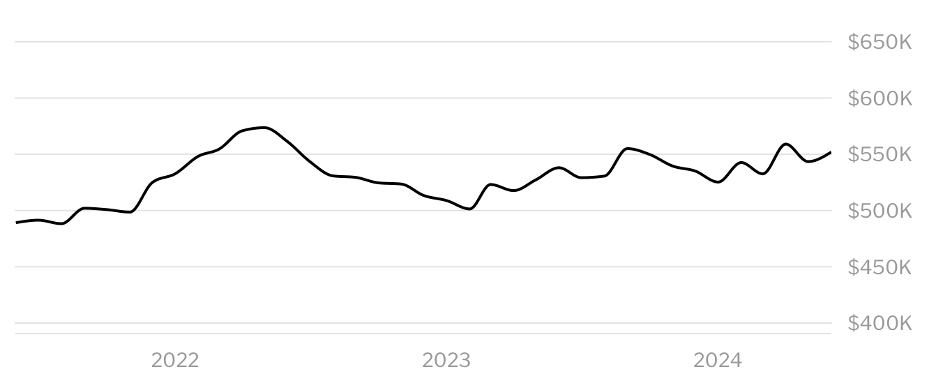

Median Home Sale Prices in Utah

Important Financial Information

- The Economy: Utah boasts a healthy economy, but buying a home requires sound financial planning. In June 2024, 26.6% of homes in Utah sold above list price[iv], which is something to consider when putting in an offer for a home. On the other hand, property tax rates in Utah are low. Utah has the sixth lowest property tax rate in the country at 0.55%.[v]

- Getting a Mortgage: Whether you have 3% to put down on a home or 20%, finding the right lender is critical. We’ll explore top Utah lenders offering competitive rates and programs tailored to first-time homebuyers or specific needs.

- Finding a Real Estate Agent: A solid real estate agent who will advocate for you in your Utah home buying journey is critical. We’ll discuss the benefits of working with an agent, along with tips for finding the perfect match who understands your needs and the local market.

Once you understand some of the important financial information, you can look at some important considerations for first-time homebuyers to make sure you’re well-prepared.

Tips for First-Time Homebuyers in Utah

- Consider State Programs: Utah offers various first-time homebuyer programs and grants. Visit the Utah Housing Corporation for more information.

- Budget for Closing Costs: In addition to your down payment, budget for closing costs, which can include fees for inspections, appraisals, and title insurance.

- Research Neighborhoods: Take the time to research and visit different neighborhoods to find the one that best suits your lifestyle and needs.

Make sure to look into down payment assistance and loan programs that you may qualify for!

Utah Down Payment Assistance and Loan Programs

| Programs | FirstHome | FHA or VA Mortgage | Conventional HFA Advantage Loan |

| Qualifications | – First time homebuyer – 660 or higher credit score | – Previously owned a home or first-time homebuyer – 620 or higher credit score | – 700 or higher credit score |

| Annual Income Limits | Yes, refer to the Utah Housing Website (https://utahhousingcorp.org/lenders/limits/) for most current annual income limits. | ||

| Maximum Sales Price | Yes, refer to the Utah Housing Website (https://utahhousingcorp.org/lenders/limits/) for maximum sales price | No | No |

| More Information | This program typically has lower purchase price and income limits and lower interest rates. | Homebuyers can purchase residence with up to 2 units | Financing option for this loan might have a higher interest rate but a lower mortgage insurance costs, which might result in a lower monthly payment. |

Now that you have all of the information, you are ready for the next steps.

Next Steps to Buying Your Utah Home!

- Get Pre-Approved for a Mortgage

- What are today’s mortgage rates in Utah? Check them out here.

- Remember: interest rates will vary by lender and by borrower, depending on factors like credit score, loan program, down payment, etc. Compare quotes from at least 3 different lenders to make sure you’re getting the lowest rate.

- Ask about down payment and closing cost assistance.

- Start by getting pre-approved to understand how much you can afford. Check out top producing loan officers vetted through Utah Housing Corporation, as well as local lenders like Mountain America, Zions Bank, and First Utah Bank.

- What are today’s mortgage rates in Utah? Check them out here.

- Find a Real Estate Agent

- Partner with a knowledgeable real estate agent who knows the Utah market. Consider agents from reputable firms like Coldwell Banker and Re/Max.

- Make sure they’re licensed, read reviews, ask questions about how they will help you, and trust your instincts to find the right person to help you buy your home.

- Start Your Home Search

- Use Zillow, Realtor.com, Utah Realty Group, Redfin, and local MLS listings to find homes in your desired area.

- Narrow down your search based on location, price, home qualities, amenities, etc. to get a better idea of what is available to you.

- Make an Offer

- Work with your agent to make a competitive offer. Be prepared for negotiations, especially in hot markets like Salt Lake City.

- Home Inspection and Appraisal

- These are critical to ensure your potential new home is in good condition and valued appropriately.

- How to prepare as a buyer:

- Accompany the inspector on the inspection

- Take notes and photos

- Carefully review the inspection report to understand the condition

- Negotiate repairs and improvements. Use the inspection report as a negotiation tool

- Close the Deal

- Once everything is in order, close the deal and get ready to move into your new Utah home!

Resources for Utah Homebuyers

- Utah Housing Corporation: Great resource for homebuyers, including information about down payment assistance, refinance, homebuyer education, and payment and mortgage calculators.

- Utah Division of Real Estate: Provides regulatory information and resources for homebuyers.

- Local Housing Market Reports: Stay updated on the latest market trends and forecasts.

- Home Buyer Education Courses: Consider taking a course to better understand the home buying process and financial planning.

Additional tips to consider:

Sources:

[i] All-transactions house price index for Utah. Federal Reserve Economic Data (FRED). (2024, May 28). https://fred.stlouisfed.org/series/UTSTHPI

[ii] Redfin. (2024, June). House Prices & Trends- Utah. Redfin. https://www.redfin.com/state/Utah/housing-market

[iii] GOBankingRates. (n.d.). The average credit score in each state — see where your state ranks. Nasdaq. https://www.nasdaq.com/articles/the-average-credit-score-in-each-state-see-where-your-state-ranks#

[iv] Redfin. (2024, June). House Prices & Trends- Utah. Redfin. https://www.redfin.com/state/Utah/housing-market

[v] Pitts, E. (2024, February 22). Some states have more affordable property taxes than others. Where does Utah rank? Deseret News. https://www.deseret.com/utah/2024/2/20/24078329/state-ranking-property-tax-value-utah-housing-market/