What Are Mortgage Rates and Why Do They Matter?

Mortgage rates determine how much interest you will pay on a home loan. These rates fluctuate based on economic factors such as inflation, Federal Reserve policies, and local housing market conditions. Whether you’re a first-time homebuyer or a homeowner looking to refinance, understanding current mortgage rates in Utah can help you make informed financial decisions.

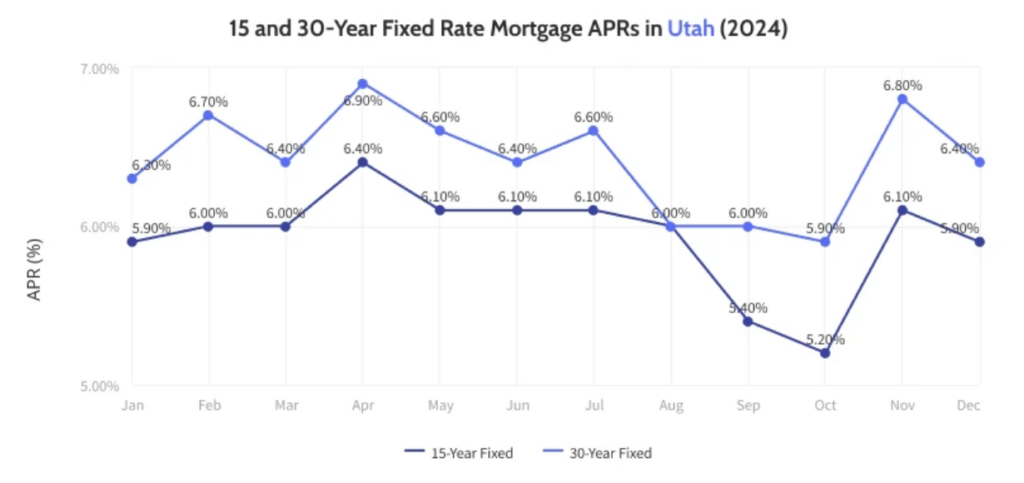

Current Mortgage Rate Trends in Utah

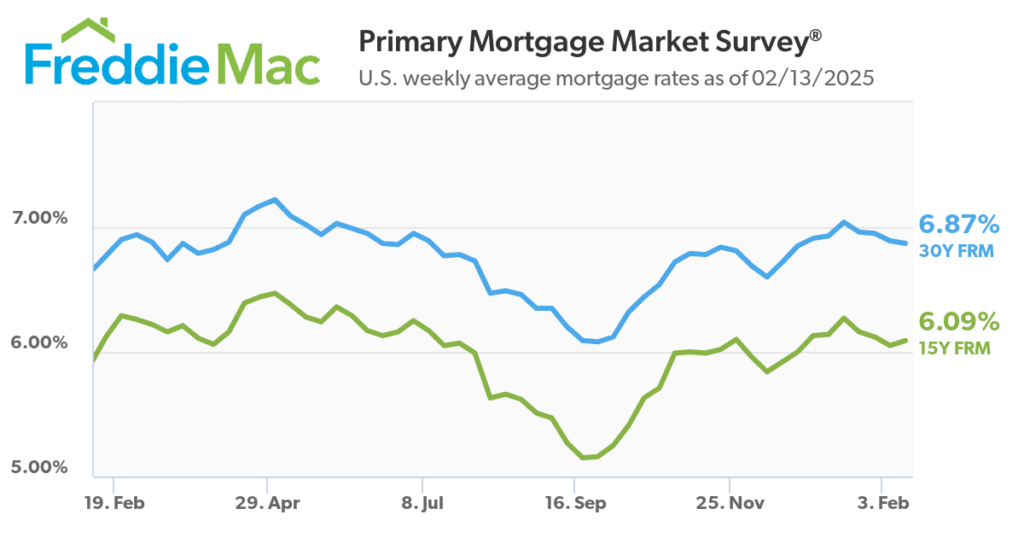

Mortgage rates in Utah are affected by market demand, lender competition, and national interest rate policies. As of February 6, 2025, interest rates have been fluctuating due to economic uncertainty and inflation concerns (as seen in the image to the left). For the latest national mortgage rate data, you can refer to Freddie Mac’s Primary Mortgage Market Survey. Homebuyers looking to lock in a mortgage should consider fixed-rate vs. adjustable-rate loans, depending on their long-term financial goals.

Types of Home Loans Available in Utah

Choosing the right mortgage is essential. In Utah, homebuyers can explore options such as:

Conventional Loans –

Best for buyers with strong credit and a solid down payment.

FHA Loans –

Ideal for first-time buyers with lower credit scores and smaller down payments.

VA Loans –

Designed for veterans and active-duty military members with benefits like no down payment.

Jumbo Loans –

Suitable for purchasing high-value homes beyond conventional loan limits.

Not sure which loan is right for you? Our First-Time Homebuyers Guide breaks down everything you need to know about qualifying for a mortgage and choosing the best loan option.

Should You Lock in Your Rate?

Given current volatility, many borrowers are asking: Should I lock in my mortgage rate now?

If rates are expected to rise, locking in a rate now could save money.

If rates may decrease, some lenders offer “float-down” options that allow you to secure a lower rate before closing.

Is Now the Right Time to Refinance?

Refinancing can help homeowners lower their monthly payments or switch to a better loan term. Utah homeowners should monitor interest rates and consider rate-and-term refinancing to reduce costs or cash-out refinancing for home improvement projects.

How to Get the Best Mortgage Rate in Utah

To secure the most competitive mortgage rate, consider:

Improving Your Credit Score –

A higher score qualifies for lower rates.

Comparing Lenders –

Rates and fees vary between banks and mortgage companies.

Locking in Rates at the Right Time –

Interest rates fluctuate, so timing matters.

Final Thoughts & Resources

Navigating mortgage rates and loan options can feel overwhelming, but understanding the basics can empower you to make the best financial decision. Check out our Mortgage Calculator to estimate your monthly payments, or visit this Loan Comparison Calculator to explore different mortgage options. For more expert insights, visit Bankrate’s Mortgage Resources for the latest industry updates.

Proudly powered by WordPress