Understanding Mortgage Rates in Utah

Interest rates for mortgages in Utah are extremely important when it comes to determining the affordability of homeownership. Whether you are a first-time homebuyer or a homeowner looking to refinance, knowing and getting the best possible rate can save you thousands of dollars over the length of a loan. Things that influence a mortgage rate include your credit score, the loan type, current and forecasted economic conditions, and lender availability in Utah. Understanding how rates work and what options you have available to you can help you make better financial decisions during the purchase or refinancing of a home.

Factors Affecting Utah Mortgage Rates

- Credit Score and Financial Health: Borrowers with higher credit scores receive lower interest rates.

- Loan Types: Depending on the type of loan you are looking for (Conventional, FHA loans, and VA loans), each has their own differences in rates.

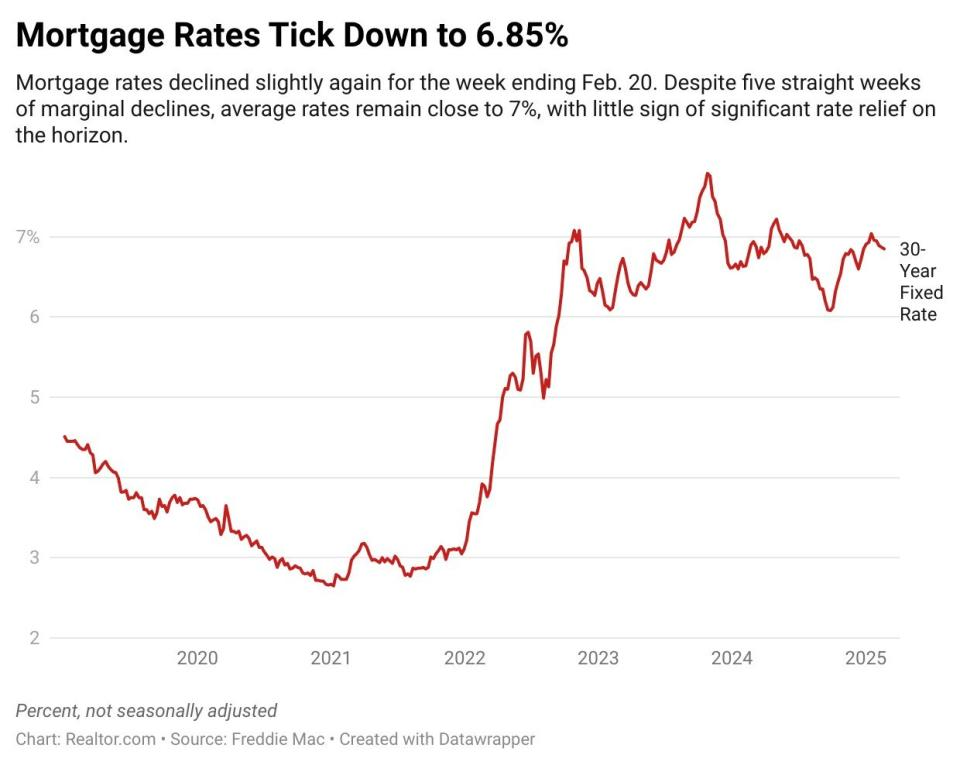

- Market Conditions: Economic indicators like inflation and the Federal Reserve’s interest rate decisions impact mortgage rates. We can see this in recent mortgage interest rates in 2025, as interest rates have risen due to inflation and steadied out.

- Loan Term: 15-year vs. 30-year refinance options affect the cost of borrowing.

- Down Payment: Higher down payments reduce interest rates and how much needs to be paid toward the mortgage monthly.

Best Mortgage Rates in Utah

To find the best mortgage rates in Utah, you need to compare the different lenders and loan types. Homebuyers can search online or work with Utah mortgage lenders and mortgage brokers in Utah to identify different rates amongst lenders. Websites with live rate updates are a great way to help you find the best deal.

First-Time Homebuyer Programs in Utah

If it’s your first time purchasing a home, Utah offers a bunch of established programs to help make it much easier in the process. These include down payment assistance in Utah, FHA loans, and grants that can vary by city or county. One example of a city grant would be in Millcreek, Utah. If you work in Millcreek, and are looking to purchase a home, consider staying in the boundaries of Millcreek as you would get a grant for $20,000 – $30,000 off your purchase. This type of grant exists in many cities throughout Utah.

Refinancing and Home Equity Loans in Utah

Homeowners looking to reduce monthly mortgage payments may consider Utah mortgage refinance rates or home equity loans in Utah. Refinancing can help a homeowner to get a lower interest rate, and home equity loans provide funding for renovations or investments into a property. It’s extremely important to compare cost vs. savings when considering refinancing options.

Summarizing Utah Mortgage Rates

To fully understand mortgages in Utah, it requires lots of research and strategic planning. Whether buying a home or refinancing, understanding factors like interest rates, loan types, and available programs can help you make the best financial decision. For more insights, check out our resources on first-time homebuyer programs and refinancing options.

Consumerfinance.org | Explore Interest Rates