Discover the true costs of homeownership beyond mortgage rates and calculators. Learn about property taxes, insurance, PMI, and more

When I purchased my first home in 2018 and joined the ranks of homeownership, I thought I had it made. Purchasing a home is one of the most significant financial decisions one can make. I remember sitting down at my MacBook and putting numbers into a mortgage calculator trying to figure out how much a loan I could qualify for. I swam through a sea of acronyms FHA, VA, HELOC, PMI, and it felt like a million others. In the end I was confused and couldn’t determine where to turn. I felt like a needed to hire a certified financial analyst to clear up my understanding.

The Basics: Mortgages Rates and Loan Calculators

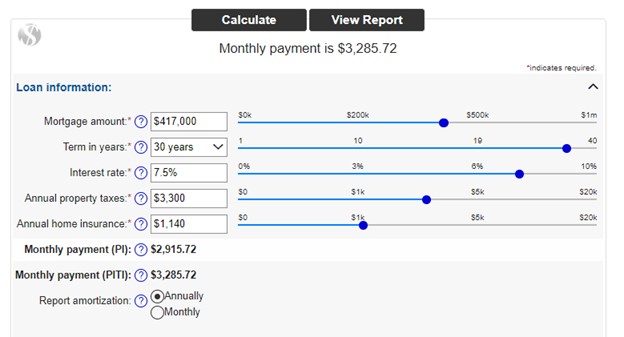

When most people think about buying a home, they start with the monthly payment to the bank often the largest outgoing expense. A good mortgage calculator estimates your mortgage payment by using the homes price, loan interest rate, loan term, estimated credit score, and down payment to calculate an estimated monthly payment. They will often help provide an estimate of monthly taxes and private mortgage insurance (PMI) as well. You can find an example of a mortgage calculator here. Another great, but slightly more technical calculator is the Zions Bank calculator. It provides estimated amortization and allows you to modify the terms lengths and customize the calculator. I prefer the Zion’s calculator because it gives you a solid report that provides all the details. To learn more about which mortgage provider is right for you check out this article.

Mortgage Payment Calculation Example:

Buying a home in Utah is expensive. Per Zillow the average Utah home value is hovering around $522k. https://www.zillow.com/home-values/55/ut/ . Buying this home with a 20% down payment means the mortgage amount would be ~$417k with a $104k down payment. Property taxes in Utah hover around 0.64% or for our home about $3,300 yearly. Insurance in Utah averages $1140 per year according to a NerdWallet analysis. Plugging these values into our mortgage calculator we get an estimated payment of $3,285.72

A lot of people stop here and assume this is the total cost of owning a home. However, in reality this is just the beginning.

Beyond the Basics: Understanding the Additional Costs of Homeownership in Utah

While the mortgage payment itself is significant other costs can add up quickly as well. Here are some of key additional expenses you should consider.

Property Taxes:

These taxes are based on the assessed value of your home and can vary widely depending on the location. Obviously, differences in tax rates between counties and cities can have a considerable impact on the overall tax rate. Local government websites typically provide information on the property tax rates for your area. One thing to remember is that assessed tax values do not always match the price you’re paying.

Homeowners Insurance:

Homeowners insurance is a must-have to protect your investment. The cost of insurance can vary depending on the location, value of the home, and level of coverage you choose. Standard policies typically protect against fire, theft, and some natural disasters. Factors that a lot of people don’t consider are distances from fire hydrants and fire stations, proximity to wooded areas, or if the property is in the flood plain. As a result, purchasing insurance for a home that is in a wooded area next to a river can be significantly more expensive then buying insurance for a comparably priced home in the suburbs.

Private Mortgage Insurance (PMI):

If your down payment is less then 20% of your home purchase price, you will likely need to pay for PMI. This insurance protects the lender in case you fail to pay the loan. The cost of PMI can range from 0.3% to 1.5% of the original loan amount annually and highly depends on the credit score and size of the down payment. Fortunately PMI can often be removed as a requirement early if the homes value increases. Following up with your mortgage provider or lender after a year or two can save thousands of dollars if the PMI requirements are dropped.

Homeowners Association (HOA) Fees:

Purchasing a home in a community with a HOA can be a blessing or a curse. These fees typically cover the cost of maintaining common areas and amenities, such as swimming pools, club houses, gyms, parks, and landscaping. These fees vary widely by the type of community. Always do your due diligence and ensure that these types of fees are included in your home budget.

Repairs and Maintenance: The Hidden Costs

Owning a home means that you are responsible for all maintenance and repairs. Unlike renting, where the landlord is responsible for ensuring the home is in tip-top shape, homeowners must budget for the routine upkeep and unexpected repairs.

Regular Maintenance:

Typically these types of repairs are not that expensive, but are ongoing. For myself the real cost here is the tools or “toys” that I’ve acquired to do the maintenance. Mowing the lawn has always been one of my favorite pastimes. At my first home I bought a $300 lawn mower from Walmart and I felt like I was giving up a kidney. This last summer I spent “a lot” more on a zero turn mower. Things like pressure washers, impact drivers, saws, and batteries for everything can be thousands of dollars in total. You don’t have to purchase everything all at once, but overtime you will likely find significant resources going towards these routine projects.

Major Repairs:

Once in a while the unthinkable happens and something major breaks. For me it was my basement freezer kicking the bucket on hot day and water leaking into and ruining the flooring and wall. It was a few thousand dollars to replace the appliances, make a few minor repairs to the walls/flooring. Luckily we were ready for it. I’ve always had a emergency fund set aside for these types of issues. Other common problems people face are water damage, roof repairs, foundation repairs, and plumbing/heating issues. Insurance may be able to cover some of these costs if they exceed the deductible, but depending on your policy you may need to front the first few thousand dollars before the insurance policy can kick in.

Improvements:

When my wife and I looked at our first home we saw a lot of potential, but unfortunately we didn’t budget for it. We discussed remodeling the kitchen and bathrooms, breaking down walls, and redoing flooring; but at our first home we never found the wiggle room to make any of that happen. We did a lot of the easy improvement, but we didn’t budget for anything major.

When my wife and I looked at our first home we saw a lot of potential, but unfortunately we didn’t budget for it. We discussed remodeling the kitchen and bathrooms, breaking down walls, and redoing flooring; but at our first home we never found the wiggle room to make any of that happen. We did a lot of the easy improvement, but we didn’t budget for anything major.

The Role of a Financial Professional

Navigating the complexities of homeownership can be challenging, and consulting with a financial professional can provide valuable guidance. A Certified Financial Planner (CFP) specializes in helping clients with comprehensive financial planning. They can assist in budgeting for homeownership, managing debt, and planning for future expenses. Their expertise can be invaluable in ensuring you make informed decisions throughout the home buying process.

Many home buyers will look to their real estate agent for financial guidance. It’s important to remember that real estate agents, although they are experienced in helping buy and sell homes, are not financial professionals. Their role ends at the point of purchase and their goals and motivations may not align with your future homeownership. This year a major court ruling pointed out an inherent conflict of interest that real estate agents face when aiding the clients.

Tips for effective Financial Planning:

To ensure that you can afford the home of your dreams and associated costs, effective financial planning is essential. Here are some tips to help manage the process.

- Create a detailed budget: outline your current monthly expenses. Determine which expenses will continue to exist after you buy a home and which will go away. Estimate the mortgage, repair, taxes, and other costs of owning a home as well as allowing for building an emergency fund and additional savings. Compare this to your income to ensure that you can comfortably afford your home without stretching too thin.

- Start Building an Emergency Fund: Get some funds set aside for homeownership. In both homes I’ve purchased we discovered some repairs needed to be made within the first six months living in the home. You never know if the sprinklers aren’t going to work, or the furnace won’t ignite, or if shower has a leak until you’ve lived there for a couple of months.

- Consider Future Expenses: If you’re planning on remodeling the basement to build the ultimate man cave, you should start planning for it now. The cost of homeownership doesn’t end when the mortgage documents are signed. Plan now so that you can meet your future needs later. If you’re looking to start saving money CD’s could be a great place to start.

- Review Your insurance needs: Evaluate the risks and assets and you need to protect. Ensure that what maybe a giant inconvenience doesn’t turn into a financial disaster through proper risk management.

Conclusion: Beyond The Cost

Purchasing a home is a monumental financial commitment that extends far beyond the simple calculation of mortgage rates and monthly payments. As we’ve explored understanding a prepaying to the myriad of costs are crucial steps to ensuring that homeownership is financially sustainable and enjoyable.