Buying a home is likely one of the most significant financial commitments you’ll ever make—exciting yet daunting! Luckily, mortgage calculators can help you cut through the confusion and get to the heart of what matters: how much you’ll pay every month and over the life of your loan.

What are Mortgage Calculators?

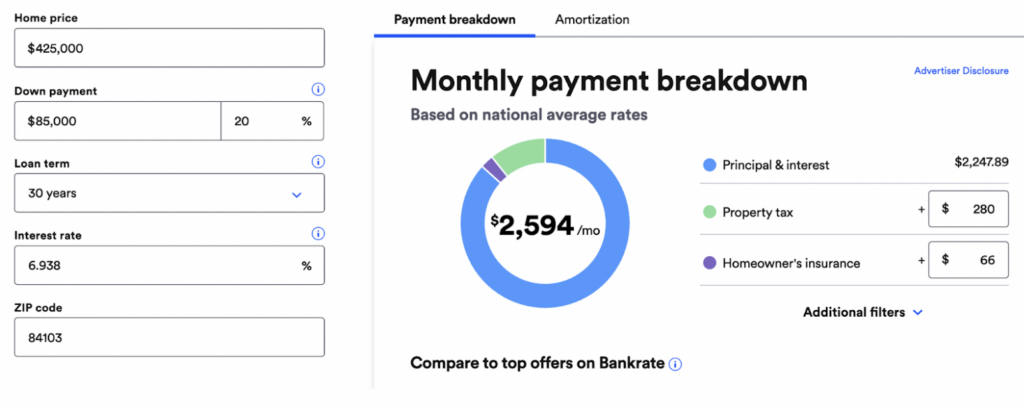

A mortgage calculator is an online tool that estimates your monthly payments using inputs like the loan amount, interest rate, loan term, and even property taxes. The best part? You can experiment with different down payments and loan terms to see how your monthly payment shifts. Want to know how a slight change in interest rate might affect your finances? For instance, just plug in the numbers and watch the magic happen.

Another key point is that by comparing various loan options, you’ll gain clarity on which scenario fits your budget and long-term goals. Therefore, there is less guesswork and more confidence when you finally decide to lock in a rate and start house hunting. Given that, whether you’re a first-time buyer or a seasoned homeowner, using a mortgage calculator is a savvy move that can help you plan like a pro. Furthermore, it allows you to enjoy the homeownership journey with much more peace of mind.

How Mortgage Calculators Work

As can be seen above, a mortgage calculator simplifies the home-buying process by estimating everything from the loan principal and interest rate to the length of your repayment period. Additionally, some calculators even let you tack on property taxes, insurance, and Private Mortgage Insurance (PMI). With this level of detail, homebuying can be a game-changer for first-time buyers. It alleviates the uncertainty surrounding mortgage decisions and empowers you to plan more confidently and clearly.

Why Use a Mortgage Calculator Before Buying a Home?

- Estimate Monthly Payments

Knowing your potential monthly expenses helps you budget effectively. A calculator can help you compare different loan terms and interest rates to find the best financing option.

- Compare Different Loan Options https://www.mortgagerateutah.com/30-year-vs-15-year-mortgage-loans/

If you’re considering different loan types, such as a fixed-rate mortgage versus an adjustable one, a mortgage calculator lets you see how each option affects your payments.

- Determine Affordability

By inputting your income and expenses, you can determine how much house you can afford. Many lenders use similar calculations to assess your eligibility for a home loan.

- Plan for Down Payments and Additional Costs

Some calculators help estimate how much you’ll need for a downpayment and other costs like closing fees and homeowners insurance.

Factors That Impact Your Mortgage Payment

Several factors influence the final amount you’ll pay each month:

- Loan Amount: The total borrowed for the home loan

- Interest Rate: A lower interest rate means lower monthly payments

- Loan Term: A 15-year loan typically has higher payments than a 30-year loan, but you save on interest

- Property Taxes & Insurance: These vary by location and lender requirements

- PMI: If your down payment is below 20%, you may need private mortgage insurance

Finding the Best Mortgage Calculator

Many authoritative financial websites provide free mortgage calculators. For example, one great resource is Bankrate’s Mortgage Calculator (https://www.bankrate.com/mortgages/mortgage-calculator/), which allows users to input various factors and see estimated payments instantly.

Final Thoughts

Overall, a mortgage calculator is an invaluable tool for anyone considering homeownership. As a result of understanding how different factors affect your monthly payments, you can confidently move forward with your home loan application. Additionally, for more information on financial planning and home buying, explore the Understanding which Mortage is Best for You and Tips page. https://www.mortgagerateutah.com/mortgage-types/