Navigating Home Interest Rates in Utah: Your Comprehensive Guide

When it comes to purchasing a home, understanding the nuances of home interest rates in Utah is crucial. Whether you’re a first-time homebuyer or looking to refinance, being informed about Utah mortgage interest rates can save you money and help you make the best financial decisions. In this guide, we’ll dive deep into mortgage interest rates in Utah, what influences them, and how you can secure the best rates possible.

Understanding Utah Mortgage Interest Rates

Utah mortgage interest rates are determined by various factors, including the Federal Reserve’s rate decisions, inflation, and the overall economic climate. Local factors such as Utah’s housing market trends and regional economic conditions also play a significant role. Mortgage lenders in Utah assess these factors to offer rates that reflect both national and local economic conditions.

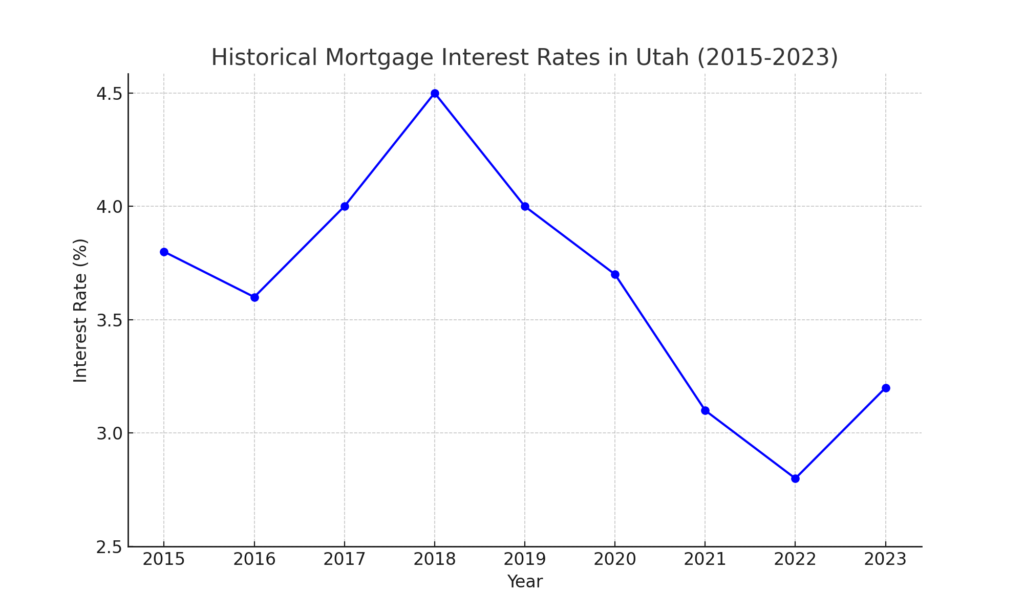

Current Trends in Mortgage Interest Rates in Utah

As of the latest data, mortgage rates in Utah have been relatively stable, but they can fluctuate due to several reasons. Keeping an eye on these trends is essential for potential homebuyers and those looking to refinance. Currently, Utah mortgage interest rates are influenced by:

- Economic Indicators: Employment rates, consumer confidence, and economic growth in Utah can impact mortgage rates. A robust economy typically leads to higher rates.

- Federal Policies: The Federal Reserve’s policies on interest rates significantly affect mortgage rates. Any changes in the federal interest rate can lead to immediate adjustments in Utah mortgage interest rates. For more information, please visit Federal Reserve Economic Data (FRED).

- Inflation: Higher inflation usually leads to higher mortgage rates as lenders need to maintain their profit margins.

How to Secure the Best Mortgage Rates in Utah

Securing the best mortgage interest rates in Utah requires a strategic approach. Here are some tips to help you get the best deal:

- Improve Your Credit Score: Lenders offer lower rates to borrowers with higher credit scores. Check your credit report for any errors and work on improving your score by paying off debts and making timely payments. For more information, check out the Consumer Financial Protection Bureau (CFPB).

- Compare Offers: Don’t settle for the first offer you receive. Compare rates from multiple lenders to ensure you’re getting the best deal. Utilize online tools to compare Utah mortgage interest rates from various lenders, such as Zillow Mortgage Rates.

- Consider the Loan Term: Shorter loan terms often come with lower interest rates. While a 15-year mortgage might have higher monthly payments, it can save you money in the long run due to lower interest rates.

- Lock in Your Rate: If you find a favorable rate, consider locking it in to protect yourself from potential increases in mortgage rates in Utah. Rate locks typically last for 30 to 60 days.

The Impact of Utah Mortgage Rates on Homebuyers

Understanding mortgage interest rates in Utah is vital for homebuyers as it directly affects their monthly payments and overall affordability. Lower rates mean lower monthly payments, which can make homeownership more accessible. Conversely, higher rates can increase your payments and limit the amount you can borrow.

For example, on a $300,000 mortgage, a 1% difference in interest rate can change your monthly payment by approximately $150. Over a 30-year mortgage term, this difference can amount to significant savings or costs.

Conclusion

Staying informed about home interest rates in Utah is essential for anyone looking to buy or refinance a home. By understanding the factors that influence Utah mortgage interest rates and implementing strategies to secure the best rates, you can make more informed decisions and potentially save thousands of dollars over the life of your mortgage. Remember, the key to navigating mortgage rates in Utah successfully is to stay educated, compare offers, and act when you find a favorable rate. Happy house hunting!