Home Buying Tips in Utah: How Current Mortgage

Buying a home in Utah? Understanding current mortgage rates in Utah—which are currently higher than the national average—and navigating the real estate market can save you thousands. With home prices rising and interest rates fluctuating, it’s crucial to be well-prepared. This guide will walk you through expert home buying tips, from getting pre-approved to securing the best financing options, so you can purchase your dream home confidently.

Why Utah is a Great Place to Buy a Home

Utah has become one of the most attractive states for homebuyers primarily because of its booming economy and job growth. With a growing tech sector, known as the “Silicon Slopes,” and a strong business environment, Utah offers excellent employment opportunities, making it an ideal place to settle down. In addition to economic stability, Utah is famous for its stunning landscapes and outdoor recreation. From world-class skiing in Park City to world renown hiking trails and national parks, Utah has it all. These lifestyle perks make homeownership even more desirable. Another major advantage is affordability in Utah and Utah remains more cost-effective than neighboring states like California and Colorado, allowing buyers to get more value for their money while still enjoying a high quality of life.

7 Home Buying Tips to Get the Best Deal

Buying a home is one of the biggest financial decisions you’ll make, and getting the best deal requires careful planning. From understanding current mortgage rates in Utah to navigating a competitive housing market, being prepared can save you thousands of dollars. The key to a successful home purchase is securing favorable financing, knowing what loan options are available, and strategically negotiating your offer. Whether you’re a first-time buyer or a seasoned investor, these seven expert home-buying tips will help you find the right home at the best possible price. By following these steps, you’ll be able to make informed decisions, avoid common pitfalls, and ensure a smooth home-buying process. Let’s dive in!

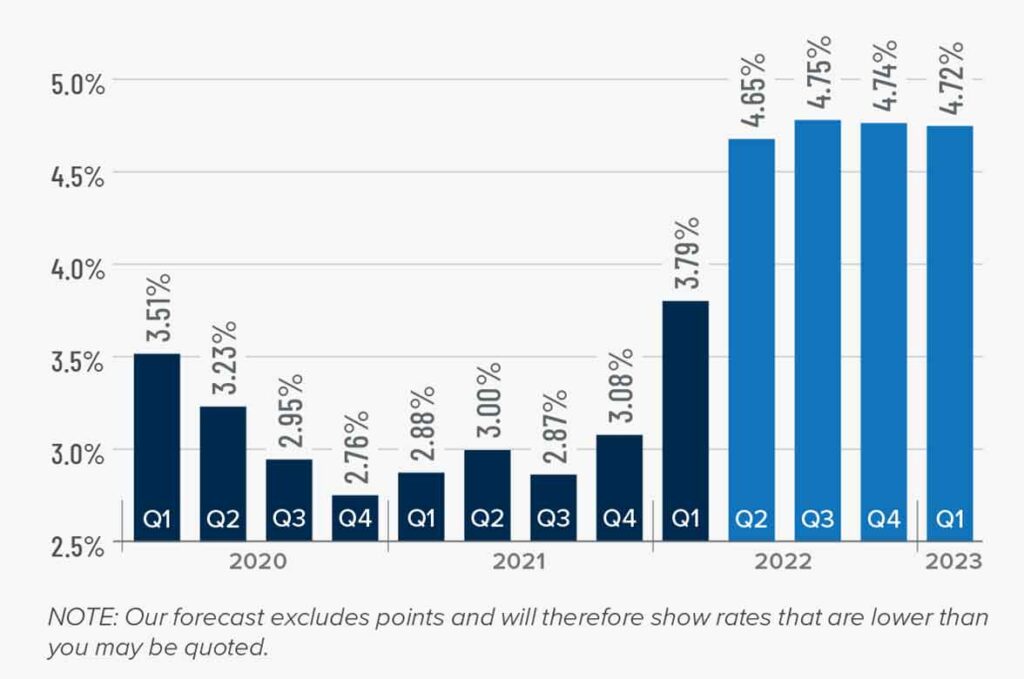

1. Check Current Mortgage Rates in Utah

Before starting your home search, it’s crucial to research current mortgage rates in Utah. Mortgage rates directly impact your monthly payment and the overall cost of your home, so staying informed can save you thousands over the life of your loan. Compare fixed vs. adjustable-rate mortgages to see which best suits your financial goals. Keep an eye on historical trends to understand whether rates are rising or falling, and consider locking in a rate when market conditions are favorable. Working with a lender early in the process can help you secure a competitive mortgage rate that aligns with your budget.

2. Get Pre-Approved Before You Shop

A mortgage pre-approval is one of the most important steps in the home-buying process. It signals to sellers that you are a serious buyer and can afford the home you are bidding on. During pre-approval, lenders evaluate your credit score, income, and debt-to-income ratio to determine your borrowing capacity. The stronger your credit profile, the better mortgage rates you can qualify for, potentially saving you thousands over the life of your loan. Getting pre-approved before house hunting also helps you set a realistic budget and avoid falling in love with homes outside your price range. you set a realistic budget and avoid falling in love with homes outside your price range.

3. Understand Your Loan Options

Choosing the right mortgage loan type can significantly impact your affordability and long-term financial stability. Conventional loans are best for buyers with strong credit and stable income, often requiring a 20% down payment. FHA loans are great for first-time buyers, offering lower down payment options and more flexible credit requirements. VA loans (for military service members and veterans) and USDA loans (for rural homebuyers) provide additional financing benefits with low or no down payment requirements. Understanding the pros and cons of each mortgage type will help you select the best financing option for your home purchase.

4. Know Utah’s First-Time Home Buyer Programs

If you’re a first-time homebuyer, Utah’s first-time home buyer programs can help make home ownership more affordable. The Utah Housing Corporation provides loans with low-interest rates and down payment assistance, making it easier to qualify for a mortgage. Additionally, various federal and state grants are available to help cover closing costs and down payments, reducing the upfront financial burden. Researching these programs and working with a knowledgeable lender can help you maximize your home-buying benefits and secure the best possible deal.

5. Choose the Right Location

Location is one of the most critical factors in determining the value of your home. The best place to buy in Utah depends on your lifestyle, budget, and long-term goals. Salt Lake City is a great choice for those seeking urban amenities, job opportunities, and a vibrant city life. Provo is ideal for families and students, with a strong rental market and great schools. If you prefer a warmer climate and scenic beauty, St. George offers a relaxed, nature-filled lifestyle with easy access to national parks. To help narrow your search, check out our in-depth breakdown of the best Utah cities for homebuyers.

6. Be Prepared for a Competitive Market

Utah’s real estate market is highly competitive, with many homes selling quickly and above asking price. To increase your chances of securing a home, be prepared to act fast when you find a property you love. In competitive areas, buyers may need to offer above the asking price to stand out. Additionally, waiving certain contingencies, such as appraisal or home inspection contingencies, can make your offer more attractive to sellers—but be sure to discuss risks with your real estate agent before making these decisions. If you’re entering a bidding war, our guide on winning a bidding war on a home in Utah has expert strategies to help you succeed.

7. Factor in Closing Costs & Extra Fees

Many buyers focus on the down payment but overlook additional expenses such as closing costs, taxes, and fees. Closing costs typically range between 2-5% of the home’s purchase price, covering lender fees, title insurance, and escrow expenses. Additional costs like home inspections, property taxes, and homeowners insurance can add to your budget. Understanding these expenses ahead of time will help you plan financially and avoid last-minute surprises. Before closing on your home, review our complete guide to closing costs in Utah so you know what to expect.

Final Thoughts: Secure the Best Mortgage Rate in Utah

Yes! We understand that buying a home is a very exciting journey, but it can also feel very stressful, especially with fluctuating mortgage rates and the competitive Utah Market. The key to a successful home purchase is staying informed about current mortgage rates in Utah and prepping in advance. Monitoring rates, getting pre-approved, and partnering with a trusted local real estate agent can help position you for success.

Even just a slight reduction in your mortgage rate will lead to significant savings over the life of your loan. Making smart financial decisions early on in the process is vital to securing the right home at the best price and one that aligns with your budget, lifestyle, preferences.

Explore Other Resources:

For additional help and guidance on navigating Utah’s real estate market and securing the best mortgage rates, visit our [Home Buying Resources Page]. You can also check trusted sites like [Bankrate] and [Zillow] for the latest Utah mortgage rates and property listings.