What are Veteran Administration Home Loans?

Veteran Administration home loans are a type of mortgage backed by the U.S. Department of Veterans Affairs, designed to help eligible veterans, active-duty service members, and certain members of the National Guard and Reserves achieve homeownership. These loans offer several advantages, including no down payment, no private mortgage insurance (PMI), and competitive interest rates. With these benefits, veterans can overcome the challenges of today’s housing market, where the current VA mortgage rates in Utah can vary. In this article, we will provide complete VA loans information with insights on the following topics: ‘Benefits of VA Home Loans’, ‘Current VA Mortgage Rates in Utah’, ‘Utah VA Home Loan Options’, and ‘How to Submit a VA Request for Certificate of Eligibility’.

Benefits of Veteran Administration Home Loans

One of the most significant benefits of Veteran Administration home loans is the ability to purchase a home without a down payment, which saves veterans thousands of dollars upfront. Moreover, VA mortgage rates in Utah are generally lower than those of conventional loans, which helps veterans save even more over the life of the loan. Another advantage is that these loans do not require private mortgage insurance (PMI), making monthly payments more affordable. The flexible VA eligibility criteria also make it easier for veterans to qualify for home loans than traditional financing options.

Current VA Mortgage Rates in Utah

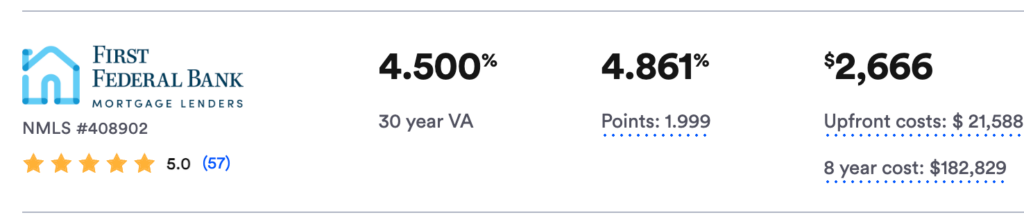

As of September 20, 2024, mortgage rates for Utah veterans seeking VA home loans start as low as 4.5%. However, these rates fluctuate based on various factors, such as economic conditions and individual creditworthiness. It is essential to regularly check the current VA mortgage rates Utah and compare them with other loan products. This will ensure you secure the best possible interest rate when applying for a loan. Veterans should also consider VA refinance rates if they are looking to adjust the terms of an existing VA loan for a better rate.

Utah VA Home Loan Options

Veterans in Utah have a range of mortgage options, including conventional loans, FHA loans, and USDA loans. However, for eligible veterans, the Utah VA home loan remains one of the most attractive choices. Not only do these loans offer lower interest rates, but the best VA mortgage lenders also provide flexible terms tailored to veterans’ needs. Additionally, understanding VA credit score requirements and VA appraisal requirements is crucial for navigating the loan process. Veterans should compare the various loan types and evaluate which option best fits their circumstances and financial goals.

How to Submit a VA Request for Certificate of Eligibility for a Home Loan

To apply for a VA home loan, veterans must obtain a VA certificate known as the Certificate of Eligibility (COE). This document verifies that you meet the necessary VA eligibility requirements to access the benefits of the loan program. The VA request for Certificate of Eligibility can be submitted online via the VA’s eBenefits portal, by mail, or through your lender. Along with your service dates and discharge status, this certificate is a key document for processing the loan. Veterans should also be mindful of the VA credit score requirements and VA appraisal requirements to ensure a smooth loan approval process.

Conclusion: Exploring Resources and GI Bill Benefits

In conclusion, the Utah VA home loan program offers a fantastic opportunity for veterans to achieve homeownership with minimal financial barriers. By taking advantage of no down payment, no PMI, and the competitiveness of VA mortgage rates, veterans can secure a home loan that meets their needs. For more information, explore our resources on first-time homebuyer tips and understanding the home loan process. To learn more about GI Bill benefits, Veterans Affairs resources, and additional VA loan information, be sure to visit the official Veterans Affairs website. Properly utilizing these benefits can make all the difference in your homeownership journey.