Buying your house is a milestone that comes with a mix of emotions, like excitement, anticipation and some uncertainty. Navigating Utah’s housing market can be overwhelming for newcomers. This blog offers tips to help you confidently start your journey as first-time homebuyers in Utah. Learn about mortgages, manage finances, and understand real estate to make informed choices for your goals and lifestyle.

Fixed Rate Mortgages:

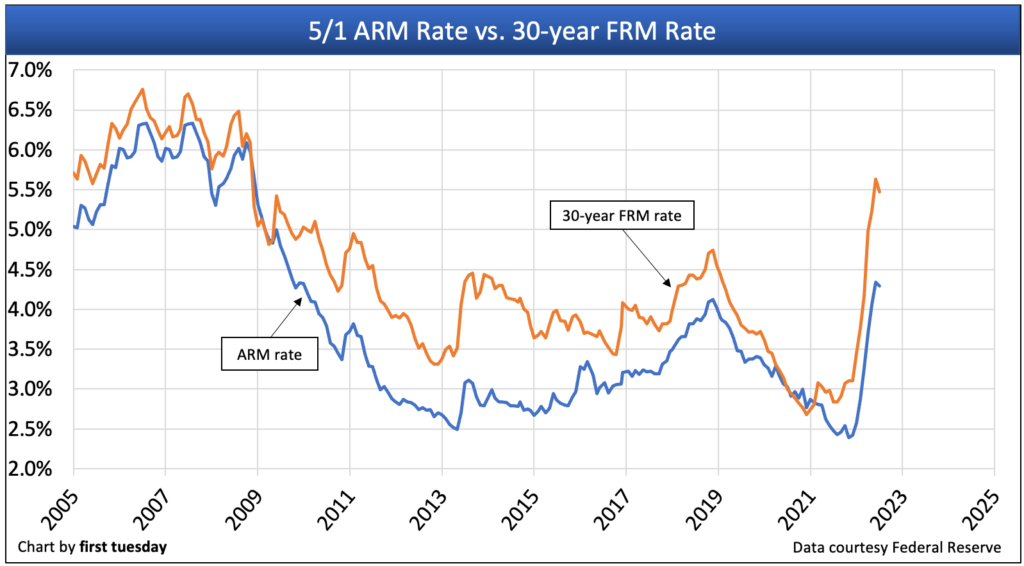

For first-time homebuyers in Utah, having a grasp of mortgage options is essential. Consider two mortgage types: fixed-rate and adjustable-rate (ARMs). Each type has its advantages and disadvantages that can impact your stability and monthly payments.

With these loans, you’ll have payments throughout the loan term, which typically lasts for 15 or 30 years. This stability simplifies budgeting and ensures your payments remain steady, giving you peace of mind.

Adjustable Rate Mortgages (ARMs); ARMs usually start with interest rates that can change based on market conditions after a fixed period. While ARMs may offer payments there’s a risk of facing higher payments, down the line.

Fixed rate home loans work well for individuals intending to live in their homes for a period and prefer the stability of payments. On the other hand, adjustable rate mortgages (ARMs) may be more suitable for those planning to relocate within a year or foresee an increase in income enabling them to take advantage of lower initial rates.

When selecting a mortgage it’s crucial to assess your status, future goals, and comfort level with risks. Consulting a mortgage specialist can provide personalized advice for your situation. Achieving homeownership starts with proper financial management.

Budgeting Tips:

- Saving for a Down Payment; Aim to put down 20% to avoid PMI and get better loan terms. Nonetheless there are loan options that require down payments if reaching 20% proves challenging.

- Understanding Closing Expenses; Besides the payment budgeting should account for closing costs, which typically range from 2% to 5% of the loan amount. These expenses cover charges related to appraisals, inspections, title insurance and other administrative fees.

- Preparing for Costs; Homeownership entails expenses, like property taxes, homeowners insurance premiums and upkeep expenditures.

- Creating an Emergency Fund; Unexpected repairs and maintenance can crop up unexpectedly. Having an emergency fund, to three to six months of living expenses can provide a financial safety net and peace of mind.

A thorough budget ensures you are financially ready for all aspects of owning a home. In addition to the purchase costs it is essential to include expenses for home maintenance and safeguarding your investment. Understanding real estate trends is vital for making decisions. Utah’s housing market is shaped by job growth, population trends, and regional economic conditions. For a deeper understanding to help you buy and sell your home, check out another one of our blog posts: https://www.mortgagerateutah.com/how-to-sell-or-buy-a-home-in-utah/

Expert Interview: Jane Doe, Real Estate Specialist

To gain insights we consulted Jane Doe, a real estate professional with over two decades of experience in the Utah market.

Q; What are the trends in the Utah housing market?

Jane Doe: The Utah housing market is witnessing growth due to a robust job market and an influx of new residents. There is a rising demand for homes, in areas as more individuals look for residences and outdoor spaces.

Prices have been going up. There are still chances for people buying a home for the time especially in up and coming neighborhoods.

Q; Which neighborhoods are seeing property values rise and which areas might be good for long term investment?

Jane Doe: Places like Sugar House and The Avenues are in demand. Have experienced significant value growth. For long term investing consider neighborhoods such as South Salt Lake and Midvale which are currently more affordable yet showing growth due to new developments and improved amenities.

Q; What tips do you have for first time homebuyers in Utah?

Jane Doe: Begin by getting pre approved for a mortgage to understand your scope. Collaborate with a real estate agent with the market. Take your time and research neighborhoods and properties thoroughly. Lastly, don’t rush your decision; ensure that the home aligns with your needs and budget.

In conclusion, Jane Doe emphasizes staying updated on market trends and collaborating with experts. Being aware of which areas are experiencing value appreciation can aid you in making an investment that will pay off in the term.

Embarking on the journey of purchasing a home in Utah is an adventure filled with both opportunities and obstacles. Learn about mortgages, manage finances wisely, and understand the housing market to navigate home buying confidently. Owning a home means creating a space for your future, cherishing memories, and feeling a sense of belonging.

Steps to Successfully Purchase Your Utah Home

Although purchasing a home may appear daunting at glance having the right information and support can make it more approachable and fulfilling. Here’s a summary of steps and advice to assist you along the way:

- Explore Your Mortgage Options: Decide whether a fixed rate or adjustable rate mortgage aligns with your circumstances and future goals.

- Manage Your Finances Wisely: Set aside savings for a payment account for closing expenses and establish a plan that considers ongoing costs along with an emergency fund.

- Stay Updated on Local Real Estate Trends: Collaborate with housing specialists to explore neighborhoods and identify promising investment opportunities.

- Obtain Pre Approval: Get pre-approved for a mortgage to know your limits and make your offer more appealing to sellers.

- Engage with a Real Estate Professional: Partner with a Utah real estate agent for guidance through the process.

- Remember to be patient and thorough: Research thoroughly to find a home that fits your needs and budget.

- Think about the run: Consider future impacts like property value appreciation and potential home upgrades when making your purchase.

First time homebuyers in Utah? Head over to Mortgage Rate Utah for resources, expert advice and tools to support you at every stage. Our detailed guides, interactive tools and local insights are tailored to make the process smoother and more enjoyable, for first time homebuyers.

Conclusion

Purchasing a home is a decision that requires careful consideration. Use Mortgage Rate Utah’s tips and resources to confidently navigate the homebuying process. Whether you’re beginning to save for a down payment or actively searching for properties, having a plan and understanding the market will set you up for success. For first-time homebuyers in Utah, it’s about finding a place that truly feels like home. With planning, informed choices and appropriate assistance you can turn your dream of owning a home in Utah into reality. Happy searching for your dream home!