With home prices skyrocketing across Utah, Millennials and Gen Z buyers are turning to mobile homes. These homes offer a smart and affordable way to escape apartment living. Imagine having your own space, a sense of community, and financial flexibility. All this comes without the burden of high mortgage payments or rent hikes. If you’re looking for an option that fits your lifestyle and budget, start with pre-approval for a mobile home loan. This guide takes you step-by-step through the process. It also answers key questions about financing mobile homes, including their benefits and challenges. By the end, you’ll feel confident about starting your financing journey.

Why Pre-Approval for a Mobile Home Loan Is Important

Pre-approval isn’t just a formality. It’s the key to a smoother homebuying experience. Lenders review credit scores, income, and financial history to determine how much they’ll lend. This process streamlines buying and shows sellers a buyer is serious.

Many buyers ask, “Is it harder to get a loan for a mobile home?” Mobile home mortgages can have more complex requirements than traditional loans. However, pre-approval and working with a knowledgeable lender simplify the process. Financing a mobile or manufactured home doesn’t have to be difficult.

How to Get Pre-Approved for a Mobile Home Loan

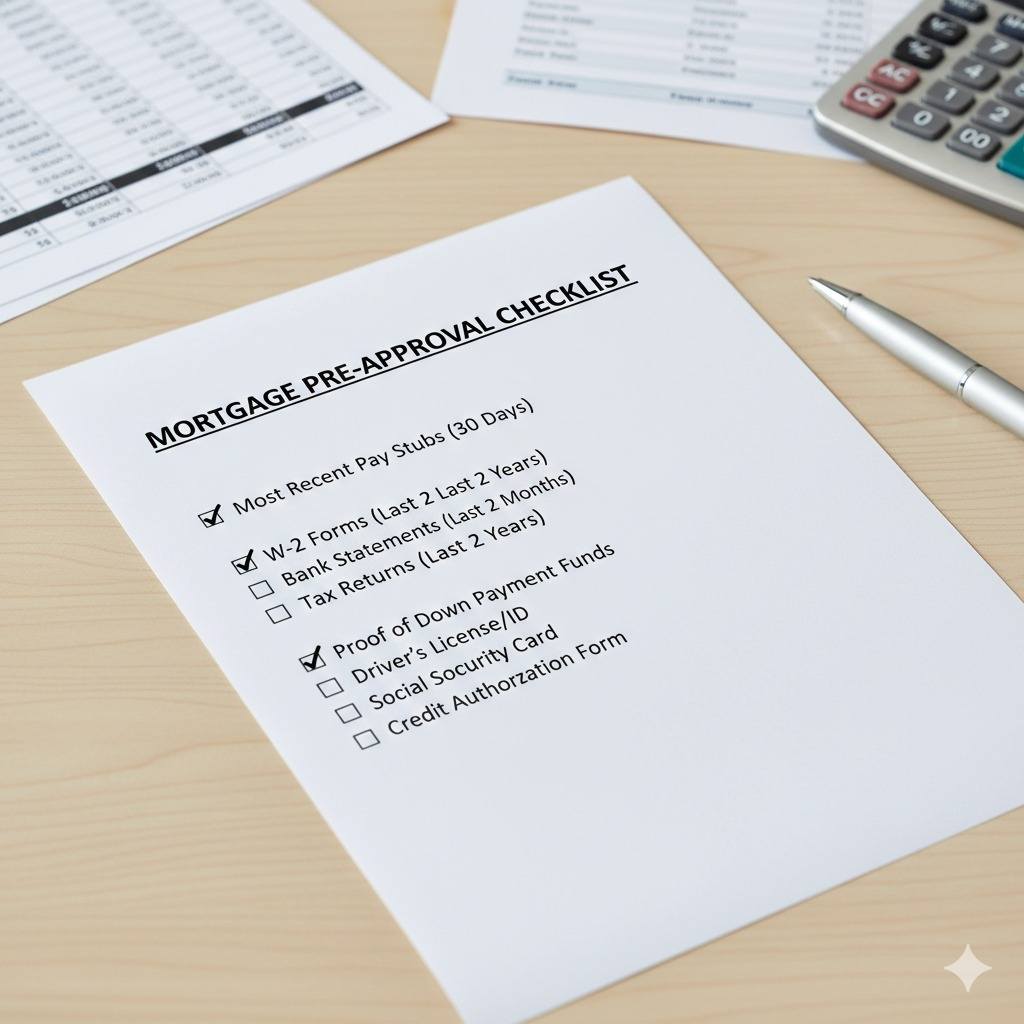

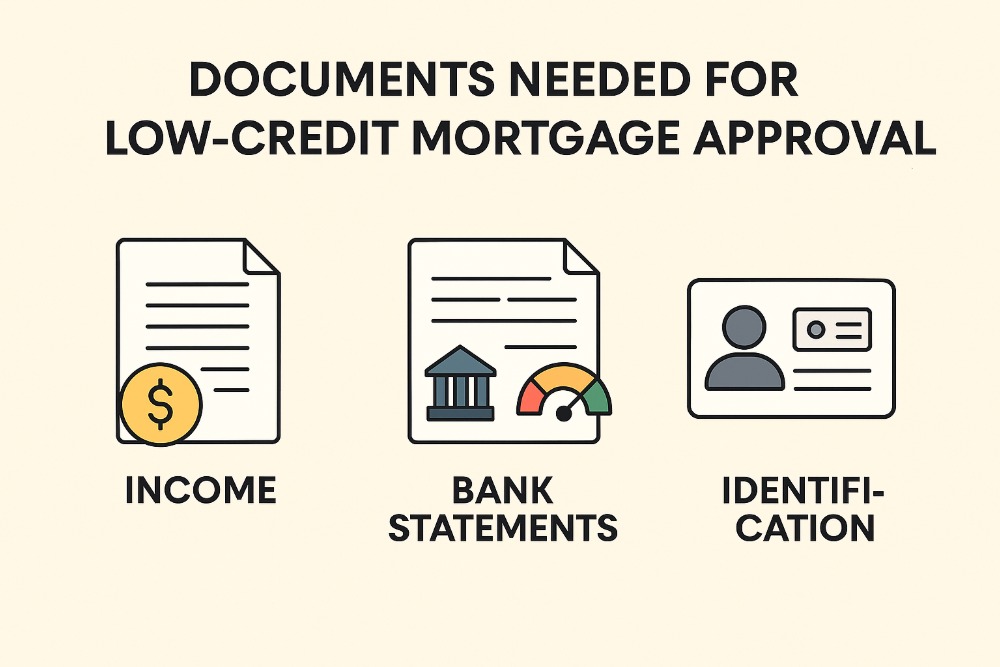

1. Gather Your Financial Documents

The first step to prequalify for manufactured home loans is to organize your finances. Lenders will require proof of income, a credit report, and verification of assets. This will allow them to evaluate whether you’re in a good position to make payments on time and manage additional financial responsibilities. If you’re wondering, “What is a method for financing manufactured homes?”, this streamlined approach ensures lenders can judge your financial health.

2. Understand Your Credit Score

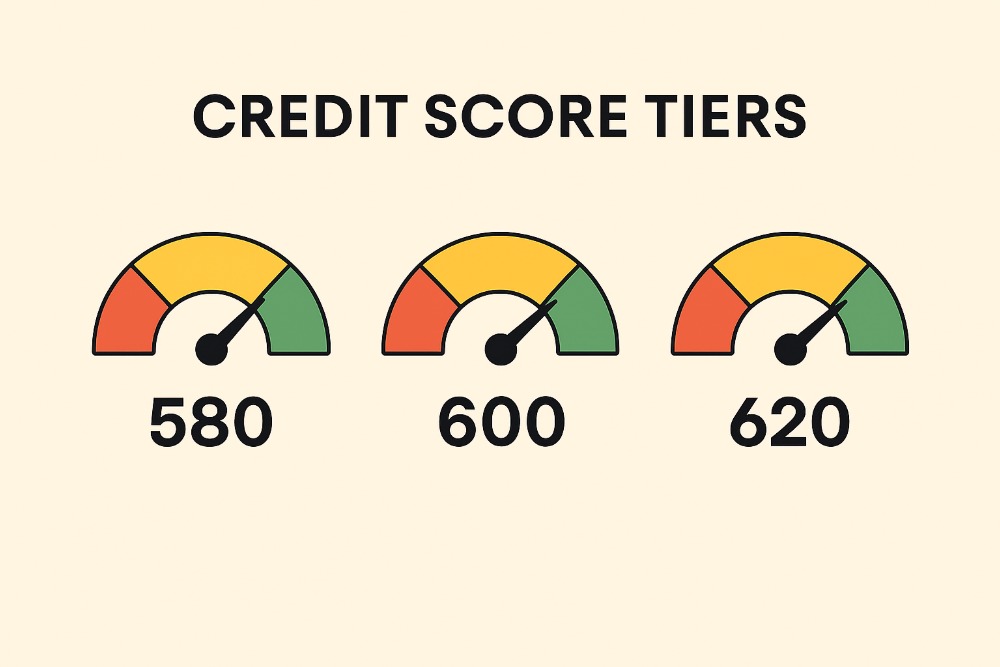

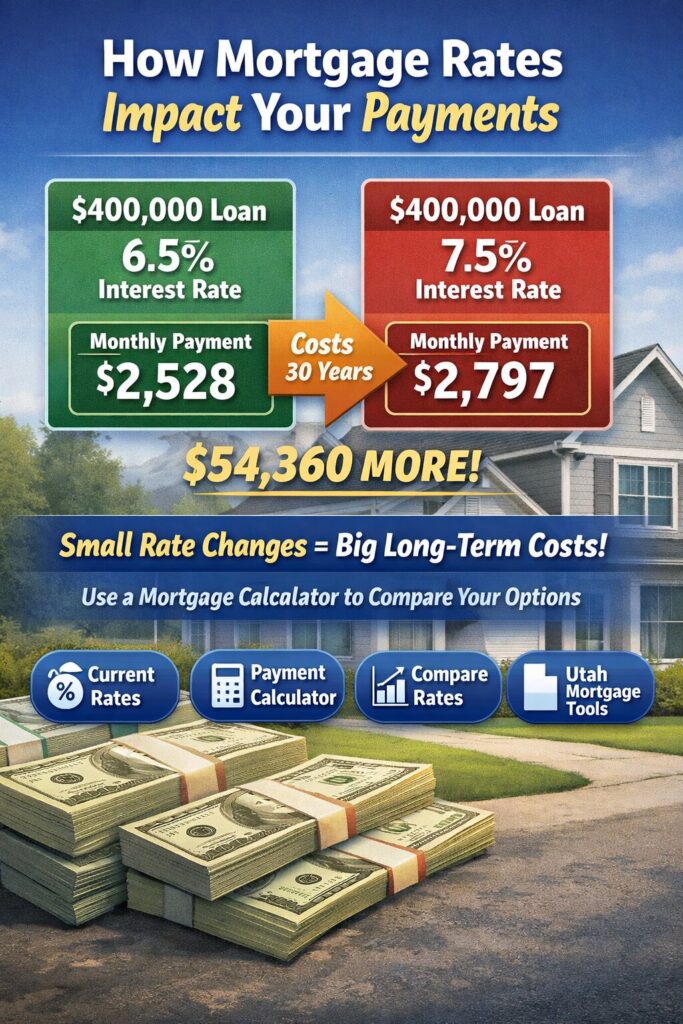

Your credit score can have a massive impact on the rates you’ll receive. Lenders often look for a score of at least 620 for mobile home loans in Utah, but options for mobile home loans for bad credit are also available with slightly higher interest rates. Take the time to pull your credit report and resolve any inconsistencies or outstanding debts before beginning.

3. Explore Loan Options

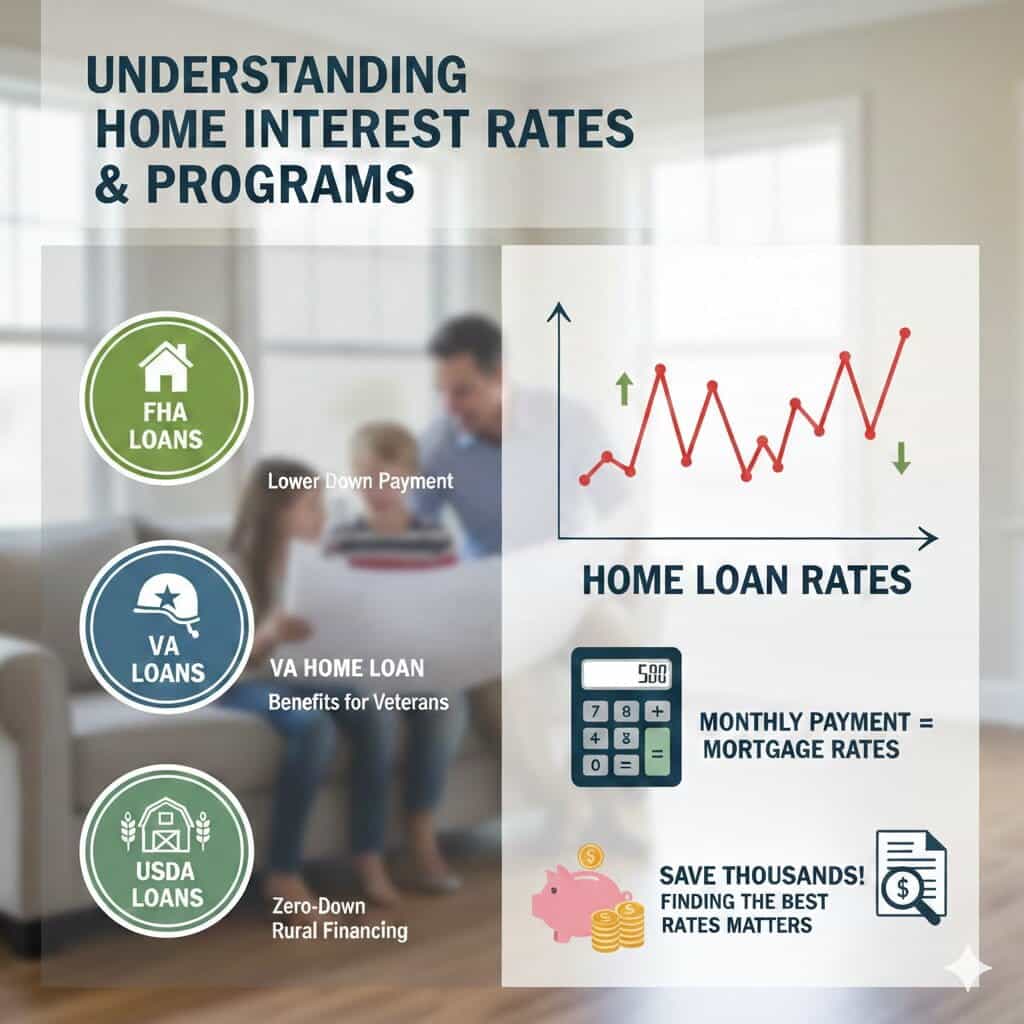

Not all financing options are created equal, so it’s important to explore what works best for your unique situation:

- FHA Loans: Backed by the Federal Housing Administration, these are great for first-time buyers seeking low down payments.

- Conventional Loans: These are available for mobile homes set on land that you own rather than within a park.

- Loans for Mobile Homes in Parks: If your home is located in a park, lenders may offer specialty loans tailored to this arrangement.

When discussing mobile home prequalification loans, it’s also worth considering the terms and flexibility of the loan. I often recommend opting for lenders who specialize in manufactured home loans since they understand the intricacies of mobile home financing.

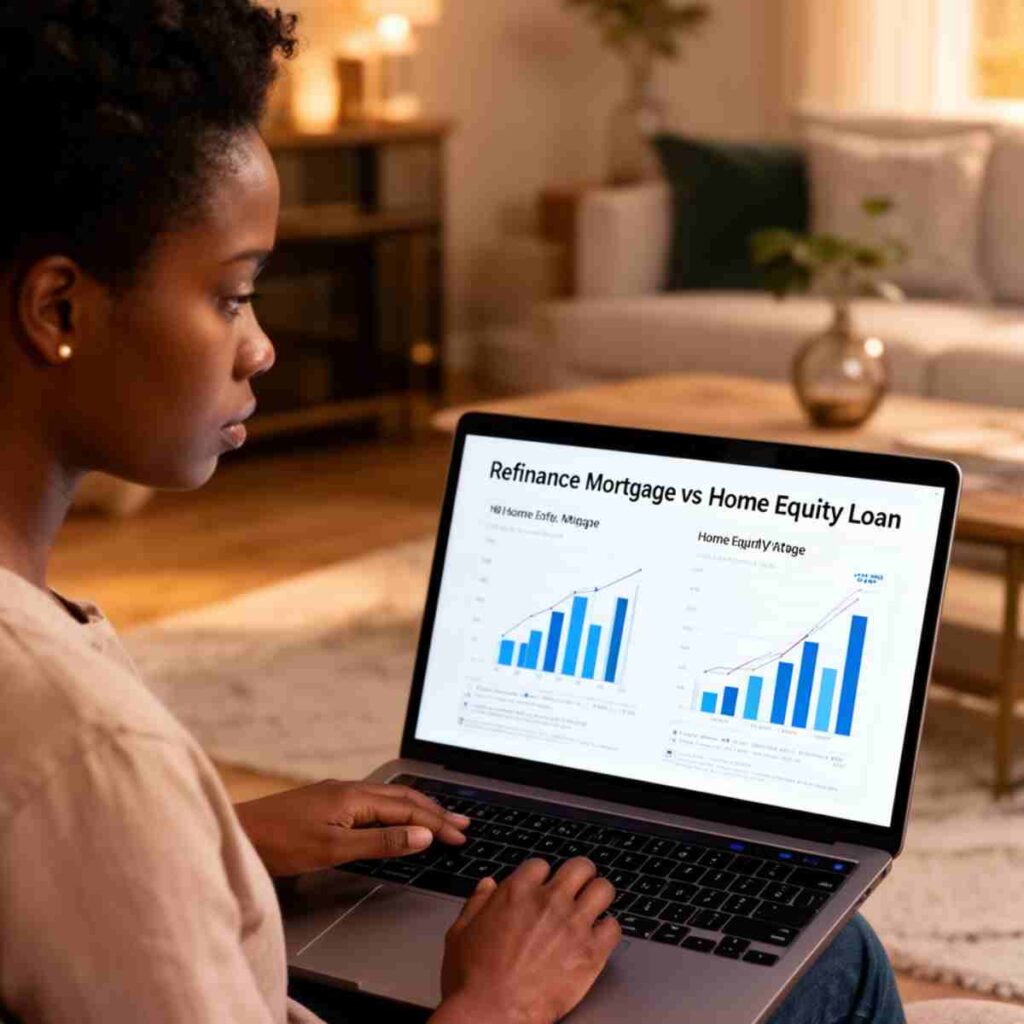

Refinancing Your Mobile Home

For those who already own a mobile home, refinancing can be a powerful way to lower monthly payments, secure better interest rates, or even switch lenders. Whether you’re seeking mobile home refinancing or the best mobile home refinancing terms available, the process will feel similar to getting pre-approved for a new mortgage.

Steps for Mobile Home Refinancing

- Check Your Current Terms: Look at your existing mortgage agreement and compare options to understand potential savings.

- Review Loan-to-Value Ratios: Depending on the equity in your home, refinancing terms can vary.

- Apply for Pre-Approval Again: It may sound repetitive, but pre-approval is just as crucial for refinancing as it is for an initial loan.

Refinancing also raises the question, “What is the lowest down payment for a mobile home?” Typically, refinancing doesn’t require a down payment, making it even more appealing for mobile home owners trying to budget smarter.

What Makes Mobile Home Mortgages Different?

A common misconception is that mobile home loans follow the same guidelines as traditional mortgages, which isn’t entirely true. While you can sometimes secure conventional mortgages on manufactured homes, most buyers will pursue specialized loan programs. Eligibility often depends on whether the mobile home is considered personal property (not attached to land) or real property (permanently affixed to a foundation).

Questions like “Can you get a conventional mortgage on a manufactured home?” and “Are mobile home mortgages different?” highlight just how crucial it is to do your research before jumping into the market.

Prequalify or Pre-Approve? What’s the Difference?

If you’ve started your financing research, you’ve likely come across terms like prequalify mobile home loans and pre-approval. While they might sound similar, there’s a significant difference between the two.

- Prequalification: A basic financial overview showing lenders your preliminary eligibility. This step requires minimal paperwork and offers a general idea of your borrowing potential.

- Pre-Approval: A comprehensive review involving credit inquiries, proof of income, and overall financial health. Pre-approval carries more weight when negotiating with sellers and finalizing interest rates.

I always advise buyers to pursue pre-approved mobile home financing, rather than stopping at prequalification. Pre-approval is far more useful for creating a competitive edge.

Unlocking More Value with Mobile Home Financing

For Utah buyers navigating the complexities of how to finance a mobile home or manufactured home, preparation is your best ally. By understanding typical mobile home loan terms and choosing the right financing methods, you’ll set yourself up for long-term success. Here are some parting tips to keep in mind:

- Know Your Options: Don’t hesitate to ask questions about manufactured home prequalification loans or compare multiple lenders.

- Stay Budget-Conscious: Base your borrowing on what’s manageable, not just what you qualify for.

- Seek Expert Help: A mortgage specialist versed in mobile home loans in Utah can provide valuable insight and simplify the process.

Final Thoughts

The process to get pre-approved for a mobile home loan may seem intimidating at first, but with the right preparation, it can be a straightforward and empowering experience. Whether you’re about to take the leap on a new purchase or exploring options to refinance your mobile home, pre-approval is the surest way to succeed. By taking these steps, you’ll put yourself in a position to secure financing that works for you—without the headaches. Have more questions? Reach out to a professional mortgage broker or explore specialized programs for mobile home loans and pre-approved mobile home financing tailored to Utah buyers.

For more information on how to qualify for a home loan in Utah, see our post “Free Mortage Estimator: Plan Your Home Loan with Confidence. “